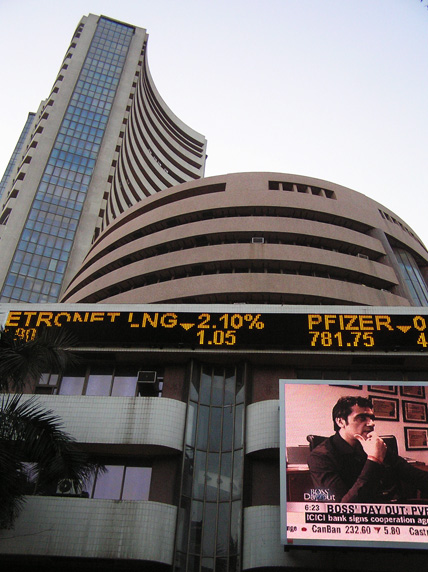

Why BSE Sensex Plunged Over 1,000 Points; Nifty50 Ended Below 22,000 – Top Reasons For Bear Attack

BSE Sensex and Nifty50, the Indian equity benchmark indices, crashed in trade on Thursday due to multiple factors. While BSE Sensex plunged over 1,000 points, Nifty50 went below the 22,000 mark for the first time since April mid. BSE Sensex ended the day at 72,404.17, down 1,062 points or 1.45%. Nifty50 closed the day at 21,967.10, down 335 points or 1.50%.

one of the main reason is the performance of index heavyweights, such as Reliance Industries (RIL) and Larsen & Toubro (L&T), significantly impacted the market. L&T experienced a nearly 5% drop due to lower margins in its core E&C segment and reduced revenues from its subsidiaries in Q4. Additionally, strong selling pressure in HDFC Bank and ITC contributed to the market’s woes, with the Nifty Bank and Nifty FMCG indices trading lower.

Thirdly, the lack of positive global cues also played a role in the market’s decline. Stocks edged lower ahead of the Bank of England’s rate decision and the release of US initial jobless claims data. The MSCI Asia Pacific Index fell 0.1%, while S&P 500 futures and Nasdaq 100 futures pointed to declines at the Wall Street open.

the market reacted to earnings announcements by top companies. While banks such as State Bank of India (SBI) and Canara Bank reported strong Q4 numbers, the market was unimpressed with Asian Paints’ earnings, causing its stock to plunge over 5% in intra-day trade. Hindustan Petroleum Corporation (HPCL) also reported a year-on-year decline in its Q4 net profit, leading to a 4% drop in its share price.

the selling by Foreign Portfolio Investors (FPIs) has weighed on the overall sentiment, as they have been net sellers in the Indian equity market so far in 2024. FPIs offloaded shares worth Rs 2,854 crore on May 8 and have sold shares worth Rs 5,076 crore in nearly a week, continuing their selling trend from March.